Latest update February 9th, 2026 12:35 AM

Canadian gold firm shifts strategy in Guyana

Jan 20, 2026 News

…drops two gold projects, bets big on Gold Hill

(Kaieteur News) – Canadian gold explorer Greenheart Gold Inc. has entered into an option agreement with “arms’ length third parties” to acquire a 100% interest in the Gold Hill project in Guyana, while terminating its option agreements for the Tamakay and Abuya projects after concluding that the deposits do not meet the size and scale required for economic development.

Greenheart Gold was formed in July 2024 as a spin-off from a business combination between fellow Canadian companies Reunion Gold and G Mining Ventures (GMIN). GMIN is the 100% owner of the 5.4 million ounces Oko West Gold project. Greenheart is focused on early-stage exploration within the geologically rich but historically underexplored Guiana Shield, which spans parts of Guyana and Suriname.

The Gold Hill project is located approximately 13.5 kilometres east of Canadian firm Aris Mining Toroparu project, which hosts an estimated 5.3 million ounces of gold in measured and indicated resources.

Greenheart said the Gold Hill property covers roughly 40 square kilometres in the Mazaruni mining district in north-western Guyana.

It was noted that the project area is deformed around a dolerite intrusion and appears to have been subjected to multiple deformation events and exhibits similar open folding to that observed at the nearby Toroparu deposit.

“The presence of multiple gold bearing vein systems on the property suggests a strong likelihood of hydrothermal alteration related to mineralizing fluids. The presence of artisanal saprolite and alluvial mining at the project area provides further evidence of the gold mineralization in the area,” the company noted.

Moreover, the company disclosed that it has decided to walk away from its Tamakay and Abuya projects following extensive exploration work that failed to demonstrate the potential for deposits of sufficient economic scale.

At Tamakay, Greenheart completed detailed mapping, 276 grab samples, 7,794 soil samples and more than 7,600 metres of trenching, supported by ground-based magnetic and induced polarisation surveys. A subsequent 1,473-metre diamond drilling programme confirmed the presence and continuity of some high-grade quartz veins associated with historic artisanal mining.

“The Company believes that the density of veining and the extent of gold mineralization are insufficient to suggest potential for an economic deposit of the size and scale required to justify development in such a remote area and has therefore elected to terminate its option with the various property owners,” Greenheart said.

Based on these results, Greenheart concluded that the density of veining and extent of mineralisation were insufficient to justify development in the remote area and terminated its option agreements with the property owners.

At Abuya, approximately 12 months of exploration included detailed mapping, nearly 2,800 soil samples, 295 grab samples and more than 3,200 metres of trenching and channel sampling.

It said, “After completing these programs, the Company did not feel that the targets warranted follow-up drilling and has therefore also decided to drop its option on the project.”

The decision marks a shift from earlier optimism around Tamakay and Abuya. In April 2025, Greenheart had highlighted promising early-stage results at both projects and committed millions of US dollars in payments to local titleholders to secure the Tamakay option. In March 2025, Kaieteur News reported that Greenheart Gold committed to over US$3.8 million in payments to local titleholders to fully acquire the Tamakay project.

Greenheart said the acquisition of Gold Hill, alongside the decision to exit Tamakay and Abuya, aligns with its strategy of rapidly assessing exploration projects and either advancing prospective targets to drilling within 10 to 12 months or moving on from properties that do not meet expectations. It added, “The Company feels that this strategy will continue to provide the highest possible chance of exploration success.”

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

- GMIN, Gold Hill, Greenheart, Greenheart Gold Inc., Guiana Shield, Oko West Gold Project, Reunion Gold

Similar Articles

One thought on “Canadian gold firm shifts strategy in Guyana”

Leave a Reply Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed.

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Feb 09, 2026

By Rawle Toney Kaieteur Sports – President Irfaan Ali took centre stage on Saturday evening as Linden celebrated the long-awaited opening of the Bayroc National Stadium, the town’s first-ever...Features/Columnists

Feb 09, 2026

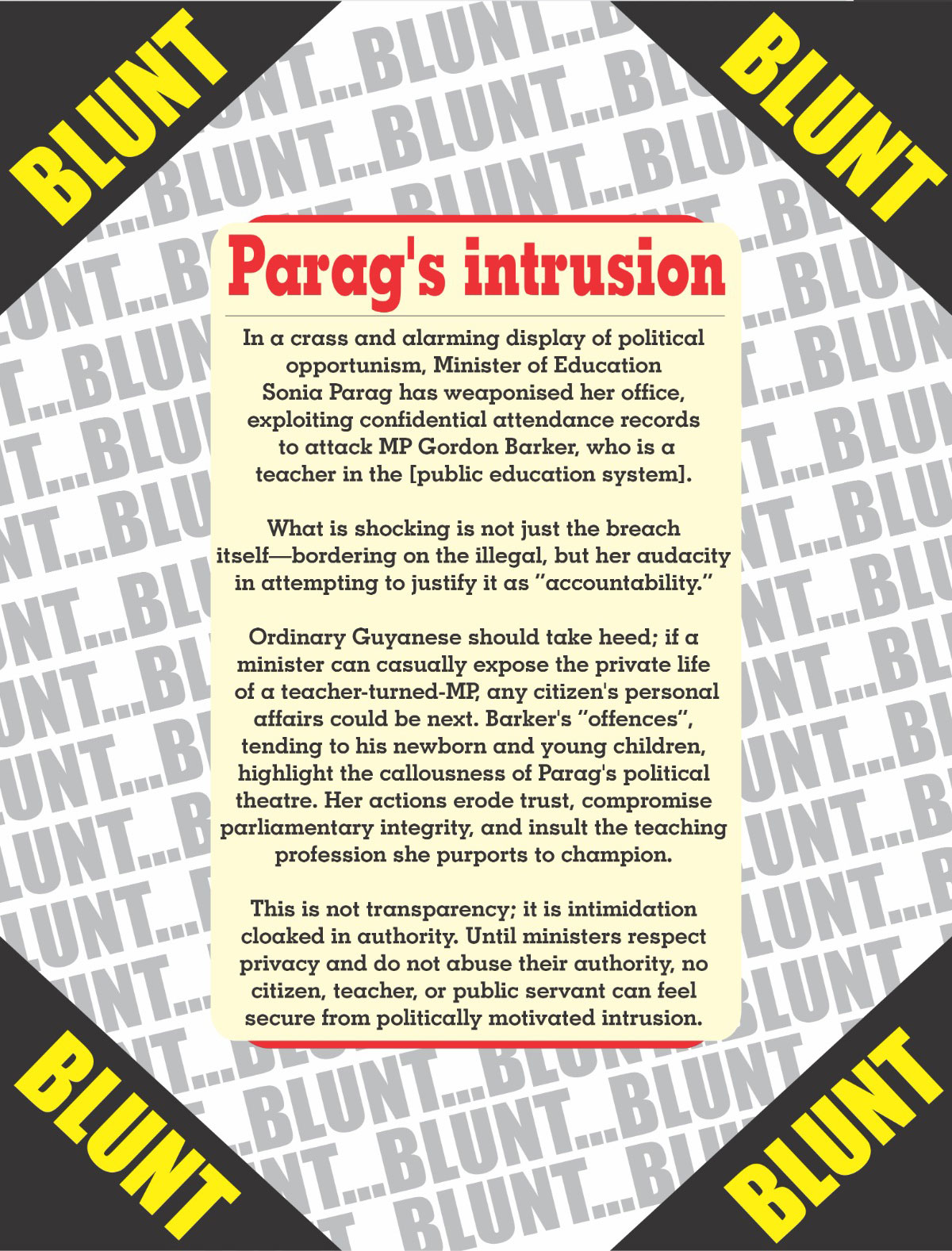

(Kaieteur News) – The recent spectacle in the National Assembly—where a Minister of Government recited the punctuality record of a teacher who also happens to sit on the Opposition benches was not a triumph of transparency. It was a confession. Not of the teacher’s lateness, but of the...Sir. Ronald Sanders

Feb 01, 2026

By Sir Ronald Sanders (Kaieteur News) – When the door to migration narrows, the long-standing mismatch between education and economic absorption is no longer abstract; a country’s true immigration policy becomes domestic — how many jobs it can create, and how quickly it can match people to...The GHK Lall Column

Feb 09, 2026

(Kaieteur News) – Guyana’s 2026 budget is a mountainous mass of green mossed numbers. Frankly, it is a One Guyana budget, for the people specially identified as belonging, invited under that tent. PPP insiders. Private sector. Brownnosers, soup-drinkers, bootlickers. Assorted hustlers...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com

Not Interested, except to Say: Canada has The Right To Opt Out, if The Project is NOT FEASIBLE/PROFITABLE!