Latest update November 29th, 2025 12:30 AM

Latest News

- Govt. closes dangerous oil-spill insurance loophole in new PSA

- Oil Fund earns US$141M in interest for 2024 – NRF Report

- ‘How can you leave the country without an Opposition Leader?’ — WIN executive member questions

- APNU demands independent probe into mining safety

- Palestine begs world: “STOP THE ISRAELI KILLING MACHINE!”

Oil Fund earns US$141M in interest for 2024 – NRF Report

Nov 29, 2025 News

(Kaieteur News) – The Natural Resource Fund (NRF) in 2024 accumulated an interest of US$141M in 2024, a substantial increase of almost 63% compared with the US$55M earned in 2023.

This is according to the 2024 NRF Annual Report, laid in the National Assembly earlier this month. The document provides highlights on the activities of the Fund, in accordance with the NRF Act of 2021.

It states, “Net return generated by the Fund totaled G$29,469.77 million (US$141.34 million) for the year 2024, a substantial increase of 62.77% (G$11,364.52 / US$54.51 million) from 2023 on account of a higher account balance and sustained high interest rates on overnight deposits during the year. Hence, an annual portfolio return of 5.095% was achieved by the Fund in 2024 compared with 4.824% in 2023.”

Notably, the report explains that the Board of Directors of the NRF met on May 16, 2024, where it approved the Investment Mandate of the Fund. “It was mandated that the funds be maintained in overnight deposits at the Federal Reserve Bank of New York. It was agreed that the Bank will continue to monitor the overnight interest rate and related market developments and inform the Chairman of any key changes to consider the feasibility of rebalancing the Portfolio items,” the document outlines.

Notably, the report explains that the Board of Directors of the NRF met on May 16, 2024, where it approved the Investment Mandate of the Fund. “It was mandated that the funds be maintained in overnight deposits at the Federal Reserve Bank of New York. It was agreed that the Bank will continue to monitor the overnight interest rate and related market developments and inform the Chairman of any key changes to consider the feasibility of rebalancing the Portfolio items,” the document outlines.

Towards the end of the year, a proposal was under consideration by the Board of Directors to revise the current investment mandate. However, at the financial year end, there was no change to the Investment Mandate as the federal funds rate remained relatively high.

The document revealed that between the period January 1, 2024 to December 31, 2024, Guyana produced a total of 225.4 million barrels of oil, compared with 142.8 million barrels in 2023.

To this end, it was noted, “As at December 31, 2024, the market value of the Fund stood at G$676,725.57 million (US$3,245.69 million), reflecting a growth of 52.93% (G$234,209.44 million / US$1,123.31 million) from the level recorded in 2023.”

The report explains that the NRF accounted for inflows of US$2,567.96 million for the year 2024, representing an increase of 59.68% when compared with inflows of US$1,608.22 million for 2023.

With regard to outflows, government withdrew a total of US$1,586.0 million in 2024, which reflected an increase of 58.26% (US$583.87 million) from the US$1,002.13 million drawn down by the GoG in 2023.

The report makes note that Brent crude oil prices fell slightly by 3.12% during 2024 moving from US$77.04/bbl. at the start of the year to US$74.64/bbl. as at end of December 2024.

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

Similar Articles

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

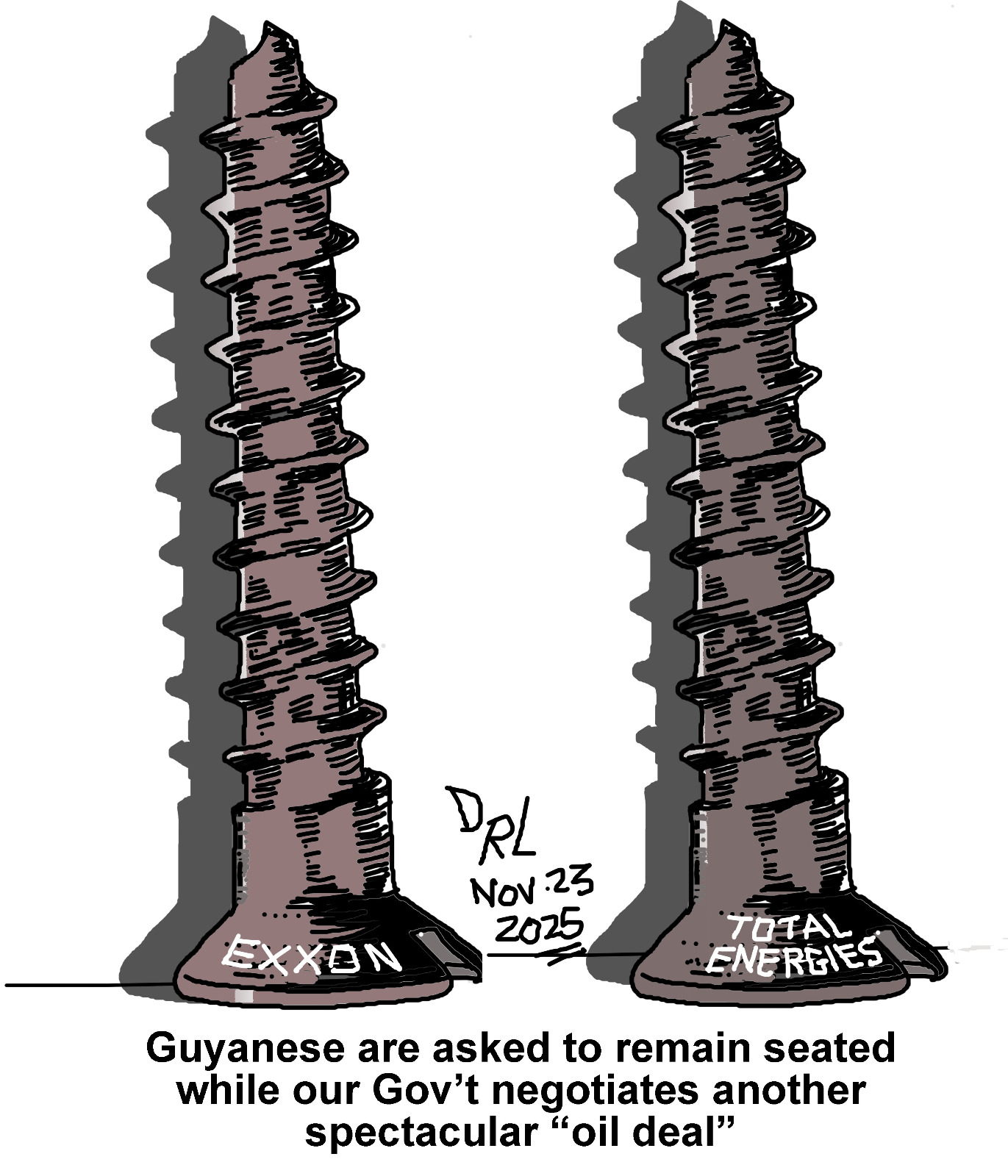

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Nov 29, 2025

– Teams briefed and Uniforms distributed Kaieteur Sports – The Kashif and Shanghai (K&S) Organisation yesterday convened a meeting with representatives of the 20 participating schools...Features/Columnists

Nov 29, 2025

(Kaieteur News) – The writing, as they say in the easy idiom of politics, was on the wall. It had been there for some time—faint at first, then steadily darkening until it acquired the heavy permanence of ink. And yet, even with its inevitability, the defeat of Ralph Gonsalves—perhaps the...Sir. Ronald Sanders

Nov 23, 2025

By Sir Ronald Sanders (Kaieteur News) – The governments of the world’s powerful nations have learned to live with disregard for human suffering. That is the bleak truth behind a new UN report whose numbers should shame every leader or diplomatic representative who speaks of global...The GHK Lall Column

Nov 29, 2025

Hard Truths by GHK Lall (Kaieteur News) – Thanks to SN’s Nov 26, 2025, semi-centerfold labeled, “EU observers report underlining vast PPP/C advantage in media coverage”, Guyanese are able to view for themselves what that caption indicates. I didn’t need to look at the two bar charts...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com