Latest update December 25th, 2025 12:40 AM

Modernising the Bank of Guyana: Promise, Practice, and Regional Lessons

Dec 25, 2025 Letters

Dear Editor,

President Dr. Irfaan Ali’s recent announcement to modernise the Bank of Guyana signals a positive and well‑timed recognition that economic transformation must be supported by an equally modern institutional and monetary framework. His call for a “data‑driven, forward‑looking” Central Bank capable of managing liquidity, inflation, and financial inclusion reflects a sound appreciation of the challenges confronting a rapidly expanding resource‑based economy.

At the conceptual level, the government’s plans align with the evolution of central banking across the Caribbean. The Central Banks of Jamaica, Barbados, and Trinidad and Tobago have each undertaken reforms to enhance data quality, transparency, and policy credibility. Jamaica’s adoption of inflation‑targeting, Barbados’s shift toward greater monetary autonomy, and Trinidad’s modernisation of its payments and supervisory systems all demonstrate the merits—and difficulties—of evidence‑based economic governance.

For Guyana, where fiscal expansion, exchange‑rate pressure, and high import dependence interact with oil‑driven growth, upgrading monetary governance is both prudent and necessary. The Bank’s modernisation could strengthen confidence, support investment, and protect purchasing power. Yet, as regional experience shows, success depends not on rhetoric but on disciplined execution and institutional coherence.

Effective monetary policy cannot function in isolation. Guyana has long suffered weak policy coordination—between the fiscal, investment, and trade authorities—resulting in liquidity surpluses, foreign‑exchange tightness, and uneven development outcomes. The modernisation of the Bank of Guyana must therefore be anchored in stronger fiscal discipline, data reliability, and transparent communication with markets.

Human‑resource capacity is also central. Reforms in Jamaica and Barbados were enabled by investment in econometric and supervisory training as well as close partnership with international institutions. If the Bank of Guyana is to manage a policy rate or open‑market operations credibly, it will require similar technical depth and professional independence.

President Ali’s emphasis on financial inclusion and the proposal for a junior stock exchange are well‑conceived measures to broaden participation in national growth. However, as shown by Jamaica’s microfinance and Trinidad’s SME experiences, financial inclusion must be accompanied by robust regulation, investor education, and effective anti‑money‑laundering oversight. Without these safeguards, liberalisation may deepen inequality rather than reduce it.

Guyana’s structural dualities—between formal and informal sectors, and between coastland and hinterland—further complicate equitable access to finance. Additionally, persistent concerns about procurement transparency, foreign‑currency leakages, and the politicisation of appointments undermine trust in institutions. The success of any modernisation effort will thus depend on visible commitment to good governance and merit‑based management.

In fairness, the government’s record since 2020 shows important progress: rapid growth in bank account ownership, improved digital banking services, and nascent steps toward better foreign‑exchange management. These achievements demonstrate intent and potential. Yet, modernisation must extend beyond technology to include clear policy rules, accountability structures, and predictable implementation.

There are useful regional lessons. Jamaica’s clear inflation‑targeting communication, Barbados’s careful sequencing of reform, and Trinidad’s pragmatic approach to macro‑prudential supervision underscore that modernisation is a process—not an event. For Guyana, success will require sustained investment in people, data, and coordination rather than one‑off announcements.

Ultimately, the government’s vision for a modernised Bank of Guyana represents a commendable step in the right direction. Its success will rest on governance coherence, transparency, and sustained institutional discipline. If achieved, Guyana could evolve not only as an oil‑rich economy but also as a regional model for credible economic management and inclusive financial development.

Yours faithfully,

Fernando Balkaran

Former Lecturer, UWI, UG

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

Similar Articles

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

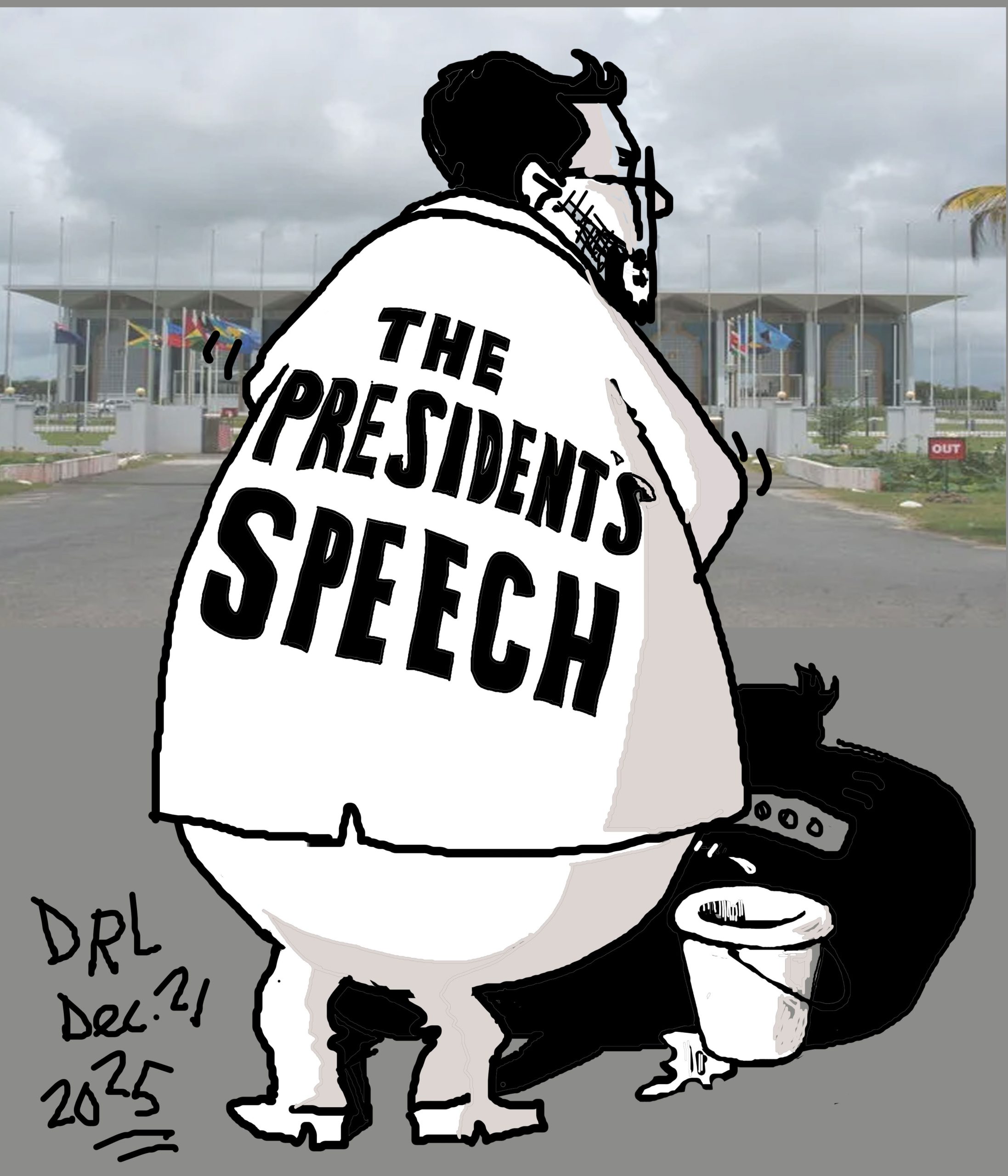

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Dec 25, 2025

…Elite League champions to face Monedderlust Kaieteur Sports – Slingerz FC will step onto the turf at the National Training Centre at Providence on Boxing Day with more than just another match...Features/Columnists

Dec 25, 2025

(Kaieteur News) – Ah, Christmas—the season of goodwill, good cheer, and, let’s not forget, good riddance! It’s that magical time when even the most hardened scoundrel can decorate a tree, stuff a chicken, and pretend they aren’t the Grinch in human form. This year, in the spirit of...Sir. Ronald Sanders

Dec 21, 2025

By Sir Ronald Sanders (Kaieteur News) – The recent proclamation issued by the Government of the United States, announcing its intention to suspend the entry of nationals of Antigua and Barbuda and the Commonwealth of Dominica, effective at 12:01 a.m. on 1 January 2026, has understandably caused...The GHK Lall Column

Dec 25, 2025

(Kaieteur News) – Merry Christmas, fellow citizens. Similar wishes are extended to strangers, visitors, partners, and others in Guyana’s new and widening commercial family. Six years of national richness ought to mean that Guyanese of all stations are in a better state financially, a happier...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com