Latest update January 27th, 2026 1:30 AM

Budget 2026 should lower corporate taxes to help cushion cost of living – Low

Jan 26, 2026 News

(Kaieteur News) – This year’s national budget will be presented today amidst a whirlwind of challenges that pose significant risks to consumers and businesses alike. To ensure lower oil price revenue does not have a damaging impact on growth, economist, Elson Low has suggested that the fiscal plan implement lower corporate taxes to not only trigger new business development, but also provide relief to consumers.

Speaking to Kaieteur News, Low pointed out that Guyana, like other petrostates, is preparing for the potential of sustained lower oil prices. This is largely due to the recent move by United States President, Donald Trump who not only abducted the president of Venezuela at the time, but announced sweeping measures to run the country and control its oil resources. Trump has since revealed his intention to use Venezuela’s oil to lower the commodity price to US$50 per barrel.

To this end, Low urged Guyana’s government to use this year’s budget to position the country to negotiate uncertainty and lower revenues.

Currently, Guyana is producing an average 900,000 barrels per day (bpd) in Stabroek Block, operated by American oil giant, ExxonMobil. The company has four Floating Production Storage and Offloading vessels (FPSOs) in operation with three other projects under development to come on stream over the next three years.

Low said while a reduction in oil prices could yield a lower cost of living, as fertiliser and transportation costs are likely to fall, without competition in the market, consumers may not benefit and growth will slow.

As such, he suggested, “the government should prioritise measures to encourage new business development, such as lowering corporate taxes and introducing innovation-based tax holidays, to incentivise this. Greater competition in the market will help ensure cost savings from these lower commodity prices are passed on to consumers while also providing more stimulus for growth in the non-oil economy.”

Low believes that by continuing with a high tax and low competition economic model, the country could suffer a period of economic stagnation and high cost of living until oil prices rebound.

The 2026 budget will be laid today in the National Assembly by Senior Minister in the Office of the President, with responsibility for Finance, Dr. Ashni Singh. Based on the revised Schedule of the Natural Resource Fund Act (NRF), government will have about $500B or US$2.4B in oil revenue at its disposal to fund its development agenda.

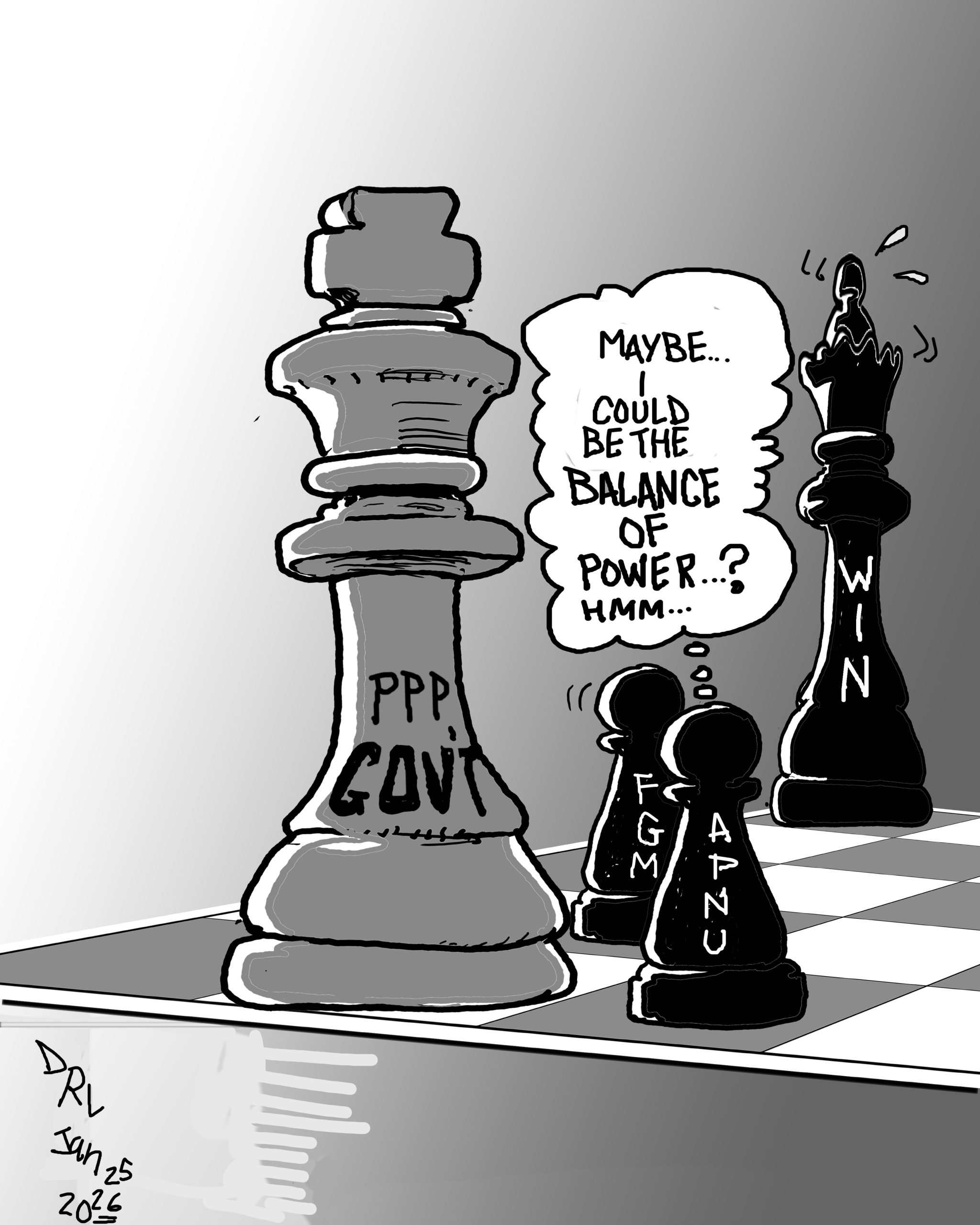

Opposition party, A Partnership for National Unity (APNU) has cautioned the administration against expanding the country’s debt burden, at a time when oil prices are likely to continue along the downward trajectory.

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

Similar Articles

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Jan 27, 2026

2026 CWI CG United Women’s Super50 Cup Round 1… Kaieteur Sports – Former Blaze T20 champs Guyana, will be on a mission to capture some new gold after dropping their title in the recently...Features/Columnists

Jan 25, 2026

(Kaieteur News) – I’m not a particularly political person. Actually, I’m hardly a person at all sometimes, at least not in the sense that people usually mean. But I have been following Guyanese politics the way some people follow serial killers. You can’t look away, even though you know...Sir. Ronald Sanders

Jan 18, 2026

By Sir Ronald Sanders (Kaieteur News) – When powerful states act, small states are tempted to personalize the action. When small states fragment, powerful states do not need to explain themselves. That is the lesson CARICOM should draw from the recent U.S. decision to impose partial visa...The GHK Lall Column

Jan 27, 2026

(Kaieteur News) – It could be rightly called Guyana’s version of a tale of two cities. Or, so that it is much easier to appreciate, I give Guyanese a new image of the haves and have nots. It is stark. Just look at the waistline of those who have it good. Then study that of those...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com