Latest update January 10th, 2026 12:30 AM

Why Guyana’s Oil Future Risks Becoming a Hostage of Global Currency Wars

Jan 05, 2026 Letters

Dear Editor,

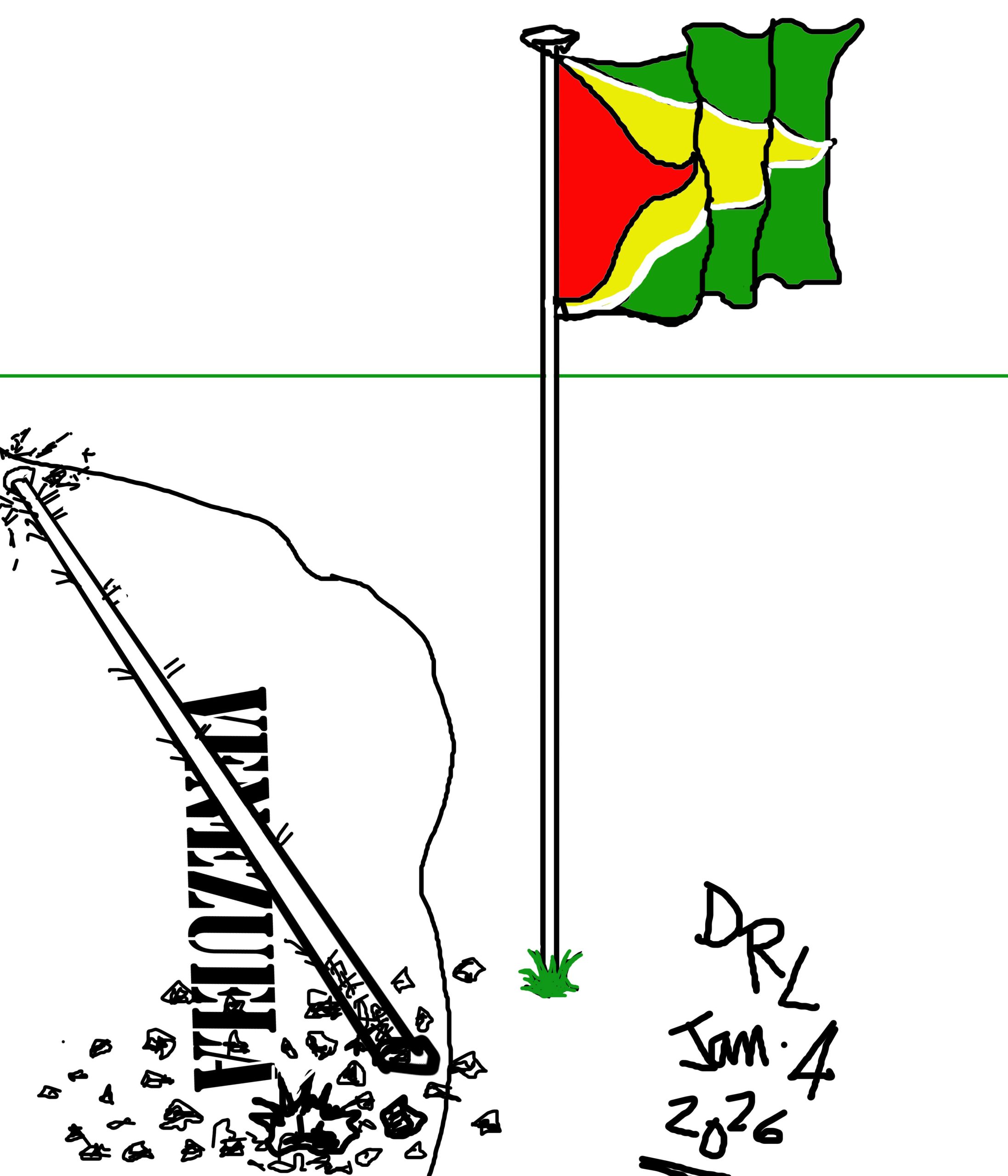

Everywhere you turn, people say Iraq, Iran, and Venezuela are about oil. But look deeper — those countries were never just about barrels of crude. They were about who controls the system around oil: how it’s priced, traded, insured, and paid for.

That same global system now touches Guyana — a young oil producer caught between two competing masters: the U.S. financial order built around the petrodollar, and a rising Chinese trade network quietly working to unsettle it.

The Global Context Guyana Can’t Ignore

When Iraq in the early 2000s suggested selling oil outside the U.S. dollar, it wasn’t just an economic gesture — it was a declaration of financial independence. The retaliation was swift and costly. That history set the tone for how any challenge to the dollar’s energy dominance is treated.

Today, China has learned that lesson — and is rewriting it in softer ink.

Through long-term oil contracts, debt-financed deals, and non-dollar settlements, Beijing has quietly built influence over the global energy trade without firing a shot.

Iran and Venezuela are now deep within China’s orbit, not through ideology but necessity. Sanctioned and isolated, they found lifelines through non-dollar trade systems and yuan-settled energy flows. Each step weakens Washington’s hold on the global settlement network — the same one Guyana now depends on almost entirely.

Guyana’s Silent Trap: The Dollar Dependency

Guyana’s economic lifeblood runs through the U.S. dollar. Nearly all oil revenue, import financing, and private-sector transactions are denominated in USD. That dependence gives an illusion of safety — until the system itself tightens. Over the past two years, businessmen from Georgetown to Lethem have felt the effects: dollar scarcity, delayed transfers, and paralysed investments. Projects stall not because the oil isn’t flowing, but because the payment circuits that translate resource wealth into cash liquidity remain bound to external control.

Local banks wait on correspondent channels. Exporters can’t settle trade in real time. Importers bid against each other just to access U.S. notes. The result? A paradox — Guyana is flush with resource value yet trapped in a liquidity squeeze. The economy grows on paper, but the cash ecosystem suffocates its private engine.

The System Shift No One’s Talking About

Globally, the game has already changed. The U.S. is no longer using physical wars to maintain control; it’s using financial architecture. Sanctions now target the connective tissue — insurers, shipping firms, ports, settlement hubs — the same arteries Guyana still relies on.

Meanwhile, China’s challenge is expanding. Through non-dollar clearing systems, digital yuan experiments, and South-South trade routes, Beijing has built a scaffolding for alternative commerce. What’s new — and relevant for Guyana — is that these options are no longer theoretical. They already function across Latin America, Africa, and Asia.

Brazil is the region’s live case study. It’s home to Pix, one of the world’s fastest, lowest-cost payment infrastructures — a real-time local settlement platform that bypasses traditional foreign exchange bottlenecks. By linking portions of Guyana’s trade into Brazil’s Pix ecosystem — particularly through the Lethem–Boa Vista corridor — Guyana could begin to localise transactions, reduce dependency on the U.S. dollar, and inject much-needed liquidity into its productive and service sectors.

A Strategic Rethink for Guyana’s Future

Guyana has an extraordinary opportunity — and a looming risk. The opportunity lies in connecting its oil wealth and trade future to a more diversified monetary and payment ecosystem; the risk lies in remaining bound to one aging system that no longer serves emerging economies well.

The dollar remains vital, but total dependence on it places Guyana in a vulnerable choke point. As the global balance tilts toward multi-currency settlement and regional payment innovation, small economies must choose whether to stay within a shrinking pipeline or build side routes that keep trade moving when global tensions rise.

In short, if Guyana wants its oil era to create true national prosperity, it must start thinking not only about what it sells — but how it gets paid. Oil may be the bloodstream of the modern world, but the heart is the system that settles the transaction. And if Guyana is to secure real sovereignty, it must have a say in which heart it plugs into.

Yours truly,

Hemdutt Kumar

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

Similar Articles

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Jan 10, 2026

(CWI) – The West Indies Under 19 squad has arrived safely in Windhoek, the capital city of Namibia, ready to compete in the 2026 ICC Men’s Under 19 World Cup which gets underway with its first...Features/Columnists

Jan 10, 2026

(Kaieteur News) – A few days ago, I saw a group of small boys roaming the streets. The look on their faces announced that they were up to mischief. They began by pelting a dog walking aimlessly on the road. Then they began to interfere with an old man. A young buxom lass passed by, andSir. Ronald Sanders

Jan 04, 2026

By Sir Ronald Sanders (Kaieteur News) – As 2025 draws to a close, the Caribbean Community stands at a moment that calls for less rhetoric and more realism. CARICOM is experiencing a period in which external pressure is intensifying, new norms are hardening among powerful states, and the need for...The GHK Lall Column

Jan 10, 2026

Hard truths by GHK Lall (Kaieteur News) – The PPP Govt can afford to be how it is today. Controlling. Complacent. Not give a damn. After all, it has everything going in its favor. Hence, from the ruling party’s position, if it is not causing any lost sleep, why tamper with what has...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com