Latest update February 4th, 2026 12:35 AM

Latest News

- Opposition leader without security, vehicle

- ‘Unemployment cut by half’ – President says wages up over 100% in key sectors

- Belize to join Guyana’s Global Biodiversity Alliance

- US refiners struggle to absorb sudden surge in Venezuelan oil imports

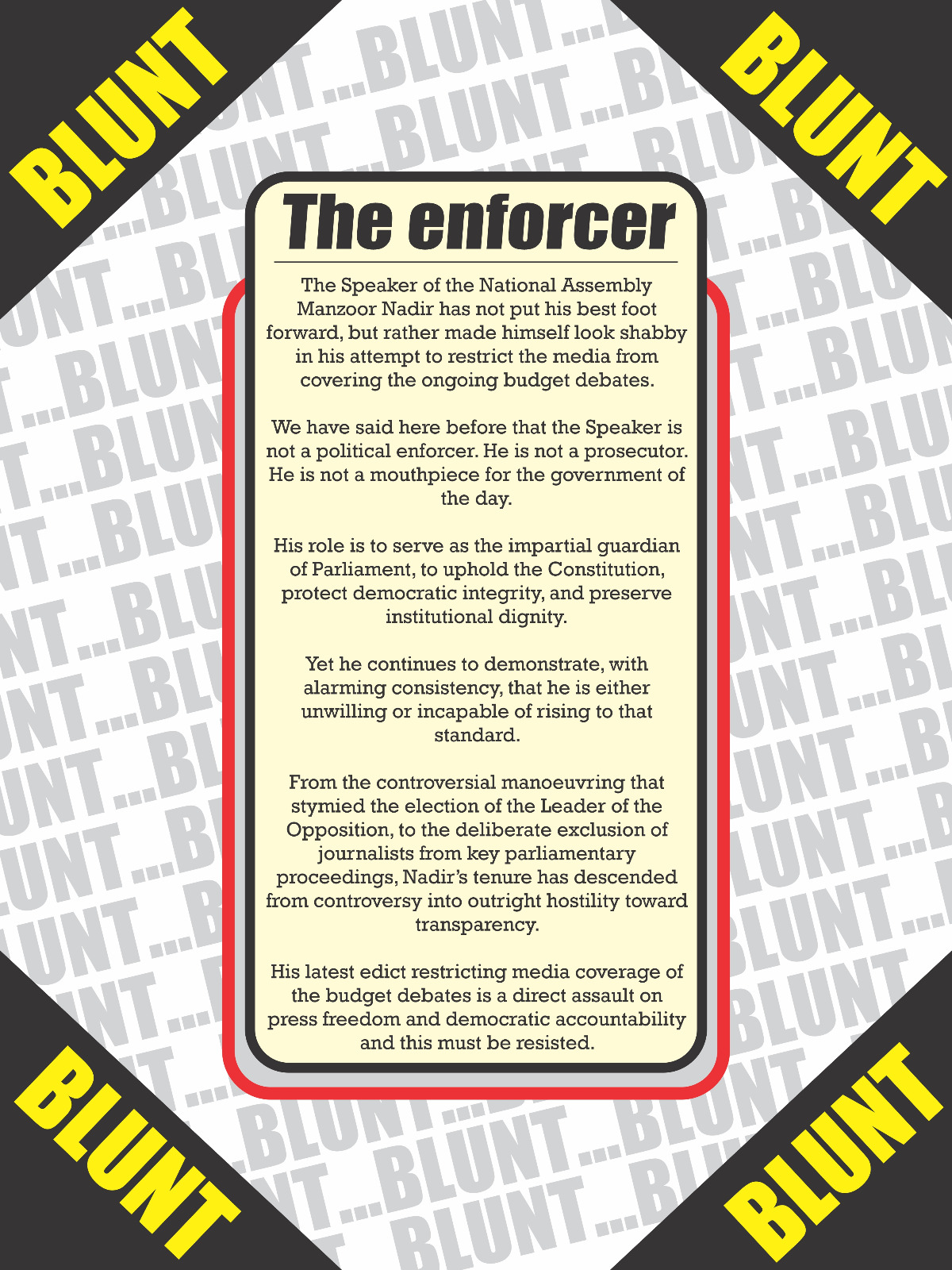

- ‘Bring a motion or sit down’ – Speaker clashes with MP over media lockout

Finance Minister meets with newly appointed Tax Review & VAT Boards, Customs Tariff Tribunal

Aug 31, 2022 News

Kaieteur News – Senior Finance Minister Dr. Ashni Singh, on Tuesday met with the incoming members of the Income Tax Board of Review, the Value Added Tax (VAT) Board of Review as well as the Customs Tariff Tribunal at the Ministry of Finance.

Senior Finance Minister, Dr. Ashni Singh met with the new members of the Tax Review and VAT Boards, and that of the Customs Tariff Tribunal.

These Boards and the Tribunal were appointed earlier in the day in accordance with Section 78 two and three of the Income Tax Act Cap. 818:01, Section 39 A of the Value Added Tax Act Cap. 81:05 and Section 22 one of the Customs Act Cap. 82:01, respectively.

The members of the Income Tax Board of Review and Customs Tribunal will serve for one year while the members of the VAT Board of Review will serve for two years.

The Boards of Review and Customs Tariff Tribunal are Boards governed by the Laws of Guyana and deal with specific tax matters for which a taxpayer is objecting. The taxpayer can appeal to these Boards for a review of taxes.

The Income Tax Board of Review (ITBOR) is a board set up under the Ministry of Finance appointed to consider Income Tax Assessment appeals.

Meanwhile, should a taxpayer be dissatisfied or is of the opinion that their Value Added Tax is incorrectly assessed, they can file an objection with the VAT Board of Review (VBOR). The objection must be lodged with the Commissioner-General in writing within 20 days of receiving their notice of assessment.

An extension can be granted to a taxpayer if they are unable to file an objection within 20 days due to any reasonable cause such as not being in the country at the time or due to illness.

In making a decision, the VAT Board of Review may make an order to affirm, reduce, increase, or vary the assessment under appeal or remit the assessment for reconsideration by the Commissioner in accordance with the directions of the VAT Board of Review. Further, a company dissatisfied with the VAT Board of Review’s decision can appeal to the Judge in Chambers, within 20 days of the service of the notice of the decision.

With regard to the Customs Tariff Tribunal, it is a tribunal which adjudicates disputes with respect to the determination of the rates of duties of customs and excise on goods as well as the valuation of goods for the purposes of assessment of such duties based on the Laws of Guyana.

Appointed as Chair of the Income Tax Board of Review was Emily Dodson, while its members are Nizam Ali, Kim Kyte, Shaleeza Shaw and Rajaindra Singh. The VAT Board of Review will comprise its Chairman Ronald Burch-Smith, Shawn Gurcharran, John Seeram, and Nizam Ali while the Customs Tariff Tribunal comprises its Chairperson Sharon Roopchand-Edwards, Dorinda Shako, Lancelot Atherley, Ramdeo Kumar, Keoma Griffith, Malisa Nokta, Dowlat Parbhuand and Richard Collymore.

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

Similar Articles

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Feb 04, 2026

ESPNcricinfo – Big picture: WI with depth and power Six-hitting is how West Indies won their last ICC title, in 2016, and the squad they have picked for the T20 World Cup in 2026 contains plenty of...Features/Columnists

Feb 04, 2026

(Kaieteur News) – Politics in Guyana is becoming a romantic comedy. It is increasingly looking like a sideshow in which everyone behaves badly, nobody learns anything, and the audience keeps rooting for the person who looks most persecuted. Take the PPPC’s ongoing vendetta against AZMO. It has...Sir. Ronald Sanders

Feb 01, 2026

By Sir Ronald Sanders (Kaieteur News) – When the door to migration narrows, the long-standing mismatch between education and economic absorption is no longer abstract; a country’s true immigration policy becomes domestic — how many jobs it can create, and how quickly it can match people to...The GHK Lall Column

Feb 04, 2026

Hard Truths by GHK Lall (Kaieteur News) – The much-watched Guyana Natural Resource Fund (Oil Fund) is expected to be boosted by US$2.8 billion in 2026. The Oil Fund needs every penn7 that it can get, given its current ragged state, thanks to the chronic extractions of the scheming PPP Govt. ...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com