Latest update March 31st, 2025 5:30 PM

Latest News

- Bandits cut through roof to rob WBD Supermarket

- Court Orders “Critic” to pay the Mohameds $52M

- ExxonM and CNOOC sticking to 11B barrels figure in Stabroek Block, but Hess says estimate higher

- Deadly Israeli strikes mar Gaza Eid celebrations

- Govt. to roll out automated speed ticketing system next week

COVID-19 forces more offshore companies to slash exploration and production budgets

Mar 24, 2020 News

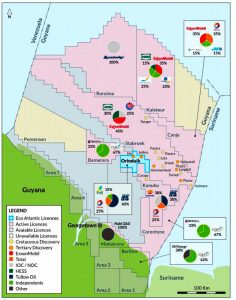

Several oil majors operating offshore Guyana are gearing up to shave billions of dollars off their exploration and production (E&P) budgets. This course of action is in response to the coronavirus outbreak which continues to keep demand on the world market at low levels.

French multinational, Total S.A, has already made it clear that in the context of oil prices being at US$30 a barrel, it would have to make major cuts to its budget. Specifically, the company’s Chairman and Chief Executive Officer (CEO), Patrick Pouyanné said that the company will cut its 2020 budget by more than US$3 billion or 20%, thereby reducing 2020 net investments to less than US$15 billion.

Kaieteur News understands that the company anticipates US$800 million of savings in 2020 on operating costs instead of the US$300 million previously announced. It also will suspend its US$2billion buyback programme.

In February, the company had announced plans to continue disciplined spending as well as the continuation of its cost reduction programme with an objective of more than US$5 billion in cumulative savings this year.

With respect to Frontera Energy which holds a significant working interest in the Corentyne and Demerara licenses, it is projected to cut its 2020 Capital Expenditure budget by 60 percent to US$130-US$150 million from US$325-US$375 million. It is also expected to streamline an Executive team on cost saving initiatives which would be applicable for the lower priced oil environment.

According to Frontera, expenditure will be primarily focused on development and maintenance activities in the company’s core assets as well as its light and medium oil business unit in Colombia.

The company also revised its average annual production for 2020. It is expected to produce 55,000 to 60,000 barrels of oil equivalent resource per day which works out to a decrease of 8% compared to its 2020 guidance. The company has also shut-in a number of wells that are not economic to operate at current prices, and is also actively working to reduce production and transportation.

As for Tullow, which has a working interest in the Orinduik and Kanuku Blocks, it is expected to cut its investment budget by about a third to US$350 million this year and reduce exploration spending – historically the group’s focus – by almost half to US$75 million. It also said the oil price fall to US$30 a barrel might jeopardize a plan to sell US$1 billion in assets to refill its coffers.

As for the major producer offshore Guyana, ExxonMobil, it has announced that significant cuts are underway. It had previously budgeted $30 billion to $33 billion for projects in 2020.

Share this:

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Related

Similar Articles

The Glenn Lall Show|| March, 28th, 2025

Follow on Tik Tok @Glennlall

THE BLUNT OF THE DAY

Sports

Mar 31, 2025

-as Santa Rosa finish atop of Group ‘B’ Kaieteur Sports- Five thrilling matches concluded the third-round stage of the 2025 Milo/Massy Boys’ Under-18 Football Tournament yesterday at the...Features/Columnists

Choosing between bad and worse

Peeping Tom… Kaieteur News- I’ve always had an aversion to elections, which I suppose is natural for someone who... more

The U.S. “Joining” the Commonwealth: an unreasonable expectation

By Sir Ronald Sanders Kaieteur News- Recent media stories have suggested that King Charles III could “invite” the United... more

Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: [email protected] / [email protected]

Weekend Cartoon