Latest update February 4th, 2026 12:35 AM

Latest News

- Opposition leader without security, vehicle

- ‘Unemployment cut by half’ – President says wages up over 100% in key sectors

- Belize to join Guyana’s Global Biodiversity Alliance

- US refiners struggle to absorb sudden surge in Venezuelan oil imports

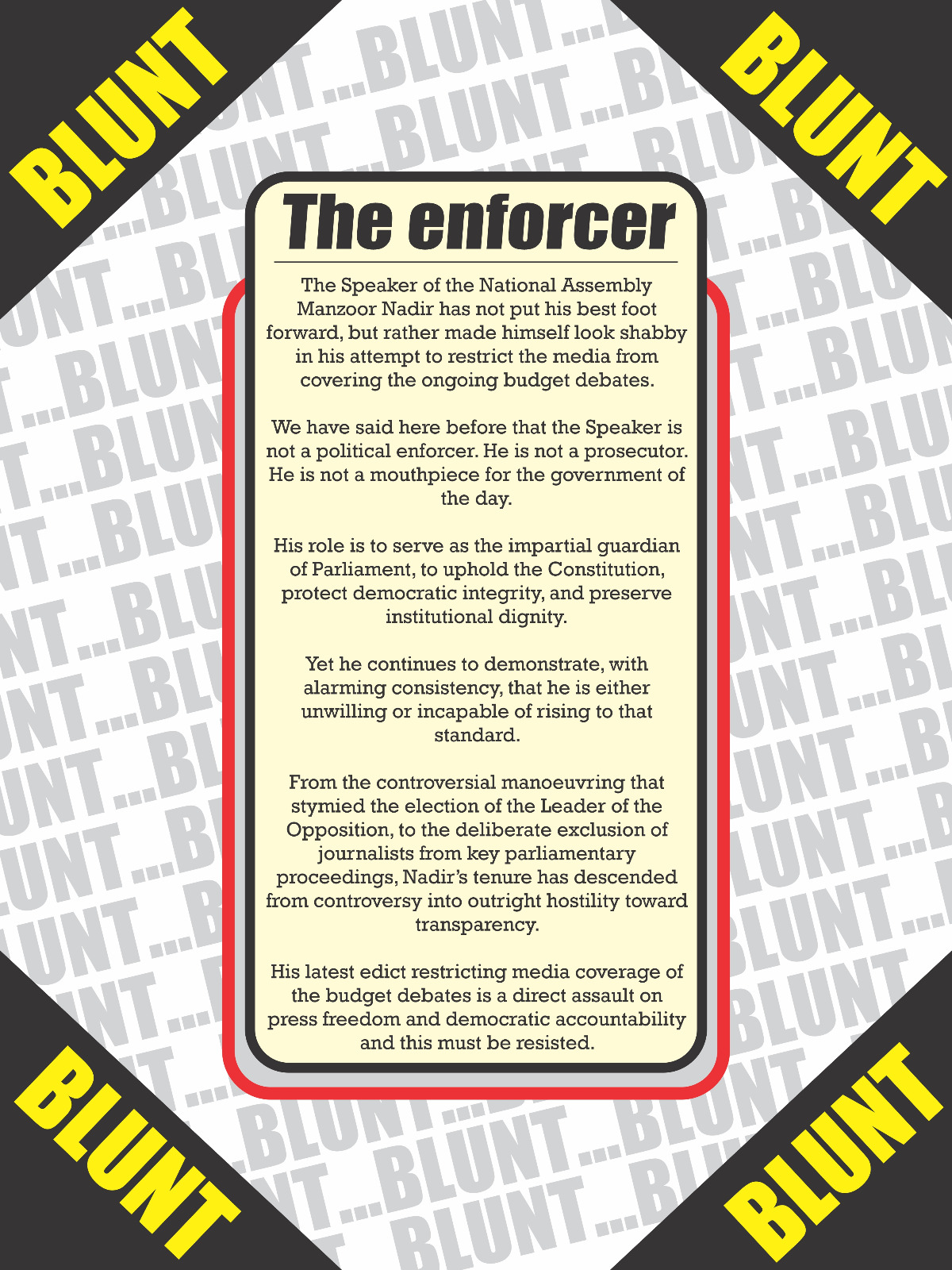

- ‘Bring a motion or sit down’ – Speaker clashes with MP over media lockout

GRA acts condignly on abuse of tax concessions

Jun 07, 2017 News

– Will go as far back as needed

By Kiana Wilburg

Over the years, there have been several forms of abuse in relation to companies which were granted tax concessions. In some cases, companies are granted concessions on machinery and equipment.

But instead of using the machinery and equipment in the forestry sector, it is transferred and used to assist the startup of businesses in the mining sector.

In other instances, companies, instead of using it for the specified purpose, sell them to related companies.

This state of affairs however is about to change as Commissioner General of the Guyana Revenue Authority (GRA), Godfrey Statia, believes that contracts bearing tax concessions need to be policed and stringent action taken where abuses are detected.

Statia made this known during an interview with Kaieteur News.

The GRA Commissioner General was asked if as recommended by the Tax Reform Commission, “sunset clauses” should be included in any new contract containing tax incentives.

In this regard, Statia answered in the affirmative while noting that this is something that was already being practised in the past. He noted that while contracts for companies with concessions had sunset clauses, these were not being imposed.

“There are clauses that if you don’t adhere to the terms of the contact then that contract could be terminated…” Statia explained.

He said that the contracts for BaiShanLin Forest Development Inc and Vaitarna Holdings Private Inc. contained sunset clauses but they were not fully enforced.

“So there are sunset clauses and I agree that there should be more stringent action. The contracts of these companies need to be policed.”

Statia also said that while he certainly supports this he also believes in the annual auditing of contracts with companies granted concessions.

The GRA Commissioner General said, “I certainly support annual audit. Notwithstanding whether a taxpayer has gotten a concession or not, he still has tax obligations and he still has to submit tax returns but we also now require that taxpayers with concessions submit quarterly status reports on what they have done and we use that to see if they are honouring their obligations.”

Statia explained that the initiative of the quarterly reports is being done in conjunction with the Guyana Office for Investment (Go-Invest). He said that concessions are recommended by Go-Invest and they are granted by GRA.

Statia also revealed that GRA’s Law Enforcement and Investigation Department would also go out in the fields and conduct checks on companies.

The GRA Commissioner General insisted that the Authority is going behind companies especially to ensure that they are honouring their contracts and obligations which formed the basis for the grant of concessions in the first place. He said too that the Authority is going as far back as is needed to ensure that it brings an end to the abuse of tax concessions. He confirmed that GRA has already made moves to act condignly in this regard.

Furthermore, a forensic audit report that was prepared by Nigel Hinds Financial Services exposed how Vaitarna and BaiShanLin failed to honour their Invest Development agreements but continued to benefit from concessions.

BAISHANLIN

Forensic auditors noted that BaiShanLin Forest Development Inc. was incorporated in Guyana in 2006 under the Guyana Companies Act. According to its business plan, BaiShanLin’s main objective was the commercial utilization of the forest resources of Guyana to produce from its processing plant a wide range of finished products.

After the Initial Investment Agreement in 2007, it was found that there were three renewals and six supplemental agreements between Bai Shan Lin and Go-Invest based on file information.

The forensic auditors said that the Supplementary Agreements in 2012 and 2013 – included a proposal for additional construction equipment and recommendations were made and granted. Also, the auditors said that there seems to be another Initial Investment Agreement for Bai Shan Lin related to Real Estate among other sectors. The forensic auditors stated that discussions with an Investment Officer at Go-Invest suggest that the second agreement was inconsistent with the polices of Go-Invest.

The forensic audit report said that during the period 2007-2012, Bai Shan Lin was cutting and exporting raw lumber without processing it or creating value added products. This was a complete contradiction of its Investment Agreement.

The forensic auditors said that it is evident that Bai Shan Lin’s real objective was to export raw lumber. Nevertheless, Bai Shan Lin still benefited from concessions totaling $1.8 Billion during the period under review 2011-2015.

VAITARNA

In its Investment Agreement, Vaitarna Holdings Private Inc. committed to setting up a wood processing facility at Wineperu, Potaro Siparuni in Region Eight. As at July 31, 2016, the wood processing facility was not engaged in any

significant production of wood products.

NO BENEFIT

An examination of the files of four Investors, Bai Shan Lin International Forest Development Inc and Vaitarna Holding Private Inc, included, shows that Guyana did not benefit from concessions granted to these Investors. The concessions were worth over $2 billion.

BaiShanLin and Vaitarna were in breach of their Agreements for years without a single sanction being instituted.

Discover more from Kaieteur News

Subscribe to get the latest posts sent to your email.

Similar Articles

Listen to the The Glenn Lall Show

Follow on Tik Tok @Glennlall

Your children are starving, and you giving away their food to an already fat pussycat.

Sports

Feb 04, 2026

ESPNcricinfo – Big picture: WI with depth and power Six-hitting is how West Indies won their last ICC title, in 2016, and the squad they have picked for the T20 World Cup in 2026 contains plenty of...Features/Columnists

Feb 04, 2026

(Kaieteur News) – Politics in Guyana is becoming a romantic comedy. It is increasingly looking like a sideshow in which everyone behaves badly, nobody learns anything, and the audience keeps rooting for the person who looks most persecuted. Take the PPPC’s ongoing vendetta against AZMO. It has...Sir. Ronald Sanders

Feb 01, 2026

By Sir Ronald Sanders (Kaieteur News) – When the door to migration narrows, the long-standing mismatch between education and economic absorption is no longer abstract; a country’s true immigration policy becomes domestic — how many jobs it can create, and how quickly it can match people to...The GHK Lall Column

Feb 04, 2026

Hard Truths by GHK Lall (Kaieteur News) – The much-watched Guyana Natural Resource Fund (Oil Fund) is expected to be boosted by US$2.8 billion in 2026. The Oil Fund needs every penn7 that it can get, given its current ragged state, thanks to the chronic extractions of the scheming PPP Govt. ...Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: glennlall2000@gmail.com / kaieteurnews@yahoo.com