Latest update April 15th, 2025 7:12 AM

Latest News

- 7th oil project likely to cause higher cost-of-living for Guyanese – Exxon study reveals

- ‘Apologise and retract false statements or face litigation’ – Former GECOM Legal Officer tells Chair and CEO

- Conditions at Gaza hospitals ‘beyond description’ after Israeli attacks -WHO

- Teen arrested in connection with murder at Melanie

- Man pretending to be Housing Minister’s father charged with obtaining money by false pretense

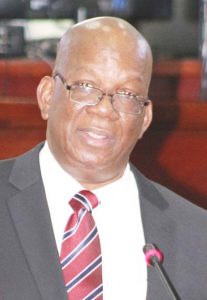

PPP introduced freezing of bank accounts – Finance Minister

Dec 04, 2016 News

-Is actually part of the VAT Act promulgated by the PPP

The move by the coalition Government to revise the Income Tax Act so as to empower the Guyana Revenue Authority (GRA) to garnish funds from bank accounts held by taxpayers has attracted much controversy.

Particularly, members of the business community have expressed concerns to the effect that GRA would be able to do garnish or seize funds from citizens’ bank accounts without the permission of the court.

They firmly believe that if this is the case, then it is not only absurd but unconstitutional.

Opposition Member, Anil Nandlall is one against the measure. The Member of Parliament in a letter to the press said that the new measure is just another attempt to invade the privacy of persons’ bank accounts.

Nandlall said, “No one will ever be comfortable with the tax authorities having power to raid their bank accounts with no reason given. It simply smacks of authoritarianism and interference with property rights which are protected by the constitution. After all, money is property.”

He continued, “What is of greater concern is the intention to ‘garnish’ people’s accounts and to seize from there, monies and to apply those monies to liquidate outstanding taxes. In my humble view, this is not only a misuse and abuse of garnishment but it is also draconian.

Garnishment is a proceeding whereby a person’s property or credits in the possession or under the control of another, are applied to the former’s debt to a third person.”

Nandlall noted that a Bill will eventually have to be tabled in the National Assembly conferring this power upon the GRA. Unless the Bill meets the litmus test of constitutionality, fairness and due process, the Opposition Member said it will be vehemently opposed by the PPP in the National Assembly.

Finance Minister Winston Jordan, explaining the proposed tax measure, emphasized that the measure is intended to assist in improving compliance with demands issued by the GRA for outstanding payments.

The economist stressed, too, that the provision of garnishment is one which already exists in the Value Added Tax Act that was promulgated by the People’s Progressive Party.

He said that while GRA already has this power under the VAT Act, what Government is simply doing is providing similar arrangements under the Income Tax Act.

The Finance Minister said that contrary to the confusion, tales and fears being spread and invoked by some, there is no move to have the new garnishment provision being used in an arbitrary manner or “willy-nilly” fashion by the GRA. The judicial system is not being removed from the process, he added. (KIANA WILBURG)

Share this:

- Click to print (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Related

Similar Articles

The Glenn Lall Show|| April, 14th, 2025

Follow on Tik Tok @Glennlall

THE BLUNT OF THE DAY

Sports

Apr 15, 2025

-GFF Elite League Season VII weekend continues Kaieteur Sports- The rumble of football action echoed once again at the National Training Centre over the weekend as Season VII of the Guyana Football...Features/Columnists

Of Silk and Steel

Peeping Tom… Kaieteur News- By the time the first container ship from China—the Liu Lin Hai—steamed into a port... more

Collaborative Government–Private Sector Action Imperative for a Resilient Trade Future

By Sir Ronald Sanders Kaieteur News- On April 9, 2025, U.S. President Donald Trump announced a 90-day suspension of the higher... more

Publisher’s Note

Freedom of speech is our core value at Kaieteur News. If the letter/e-mail you sent was not published, and you believe that its contents were not libellous, let us know, please contact us by phone or email.

Feel free to send us your comments and/or criticisms.

Contact: 624-6456; 225-8452; 225-8458; 225-8463; 225-8465; 225-8473 or 225-8491.

Or by Email: [email protected] / [email protected]

Weekend Cartoon